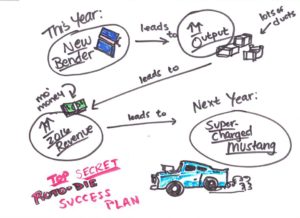

Our secret plan to success!

Many are familiar with the Section 179 tax deduction, and the benefits that it allows businesses. Here are some quick facts about the deduction, which could be very useful to you when considering new machinery additions to your shop:

- The Section 179 tax deduction limit is $500,000 in 2016.

- The deduction is good on new and used equipment.

- In order to take advantage of the deduction, the equipment has to be purchased and put into service by the end of the day 12/31/16.

- The deduction allows you to the full purchase price from your gross income.

- The deduction is an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Have you been holding off on upgrading or adding to your current equipment? Now is a great time to act in order to make sure you are taking full advantage of the 2016 Section 179 deduction. The form to sign up for your deduction, and more details about that form can be found here.

If you do decide to take advantage of the deduction before it’s too late, we have plenty of refurbished machinery available for purchase. Click here to find out more.